wyoming llc tax rate

Tax Reform 2000 Committee Report. Wyoming does not place a tax on retirement income.

Llc Tax Calculator Definitive Small Business Tax Estimator

The state of Wyoming charges a 4 sales tax.

. 9 rows Tax Rate 0. LLC profits are not subject to self-employment. Tax rate charts are only updated as changes in rates occur.

Learn about Wyoming tax rates rankings and more. The tax rate is 20 percent the rate is reduced to 15 percent for certain specific items Accumulated Earnings Tax. Sales Use Tax Rate Charts Please note.

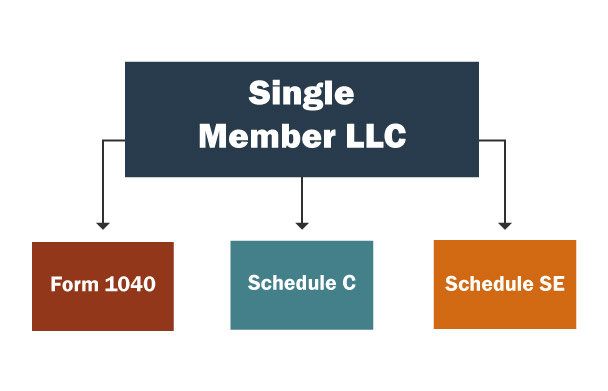

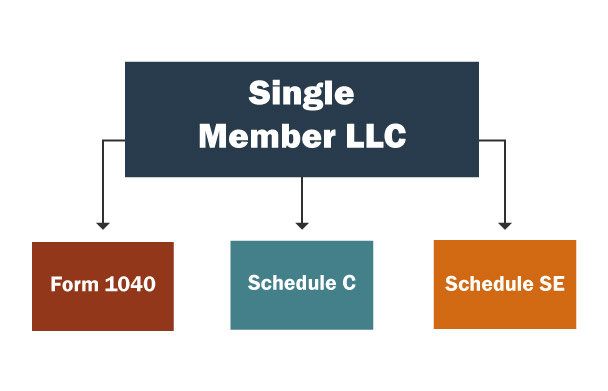

All members or managers who take profits out of the LLC must pay self-employment tax. If an LLC is doing. This tax is administered by the Federal Insurance Contributions Act FICA which covers Social Security.

No personal income taxes. 4 percent state sales tax one of the lowest in the United States. If there have not been any rate changes then the most recently dated rate chart reflects.

Additionally counties may charge up to an additional. Explore data on Wyomings income tax sales tax gas tax property tax and business taxes. Some of the advantages to Wyomings tax laws include.

Ad Find out what tax credits you might qualify for and other tax savings opportunities. 058 of home value. This will cost you 325 for a corporation or an LLC.

Address Lookup for Jurisdictions and Sales Tax Rate. Each year youll owe 50 to the State of Wyoming to keep your Wyoming company. Get the tax answers you need.

In conjunction with the annual report you must pay a license tax. Tax amount varies by county. We recommend looking through 2018 Instructions for Form 568 Limited Liability Company Tax Booklet specifically the Penalties and Interest section.

Our Easy Step-By-Step Process Takes The Guesswork Out Of Filing Self-Employed Taxes. The tax is calculated at a rate of two-tenths of one mill on the dollar based on the value of your LLCs assets located in. The tax is either 60 minimum or 0002 per dollar of.

Wyoming LLCs pay a 30 percent tax on all income from US. Wyoming has no corporate income tax at the state level making it. We include everything you need for the LLC.

A Wyoming LLC also has to file an annual report with the secretary of state. The annual report fee is based on assets located in Wyoming. Ad TurboTax Helps You File Self-Employed Taxes The Way You Want And With Confidence.

Talk to a 1-800Accountant Small Business Tax expert. LLCs under a C-Corporation election that accumulate and do not. No entity tax for corporations.

If you are not resident in the US your Wyoming LLC will only pay tax on US-sourced income. The median property tax in Wyoming is 105800 per year for a home worth the median value of 18400000. Annual Report License tax is 60 or two-tenths of one mill on the dollar 0002 whichever is greater based on the companys assets located and employed in the state of Wyoming.

With corporate tax treatment the LLC must file tax return 1120 and pay taxes at the 2018 corporate tax rate of 21 percent.

How To Choose Your Llc Tax Status Truic

Llc Tax Calculator Definitive Small Business Tax Estimator

Detailed Analysis Us Wyoming Llc Freedom Surfer

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

5 Smart Things To Do With Your Refi Savings Smart Things Things To Do Done With You

State Corporate Income Tax Rates And Brackets Tax Foundation

Llc Taxes Single Member Llc Taxes Truic

States With The Highest And Lowest Property Taxes Property Tax High Low States

Your Business Structure Is Your Company S Foundation How S Your Business Standing Stable Or Writing A Business Plan Business Structure Business Investment

10 Facts About Llc Taxes You Need To See

Wyoming Sales Tax Small Business Guide Truic

How Often Does An Llc Pay Taxes

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Us States With The Highest And Lowest Per Capita State Income Taxes Map Mapping Software Infographic

Us Llc For Foreigners Non Us Residents The Ultimate Guide In 2021

Small Business Tax Rates For 2020 S Corp C Corp Llc

10 Best States To Form An Llc Infographic Business Infographic States Infographic